AirSmat announced a partnership with Sterling Bank to enable farmers to increase their output by leveraging quality farm data and AI-generated recommendations. In this partnership, AirSmat will deliver enabling technology capabilities for Sterling Bank to monitor farm activities throughout the planting season and help farmers improve their productivity and secure the supply chain of the future.

In a statement released by the company, AirSmat with its technology will deliver unique agronomic insights alongside remarkable acre-by-acre to drive efficiency in farm activities reporting for Sterling Bank and farmers that are direct customers of the bank. Sterling Bank’s team of experts will access this farm data through AirSmat’s in-house-built application, FarmManager, to deliver valuable insights to the bank’s Agric Desk team, stakeholders, and shareholders.

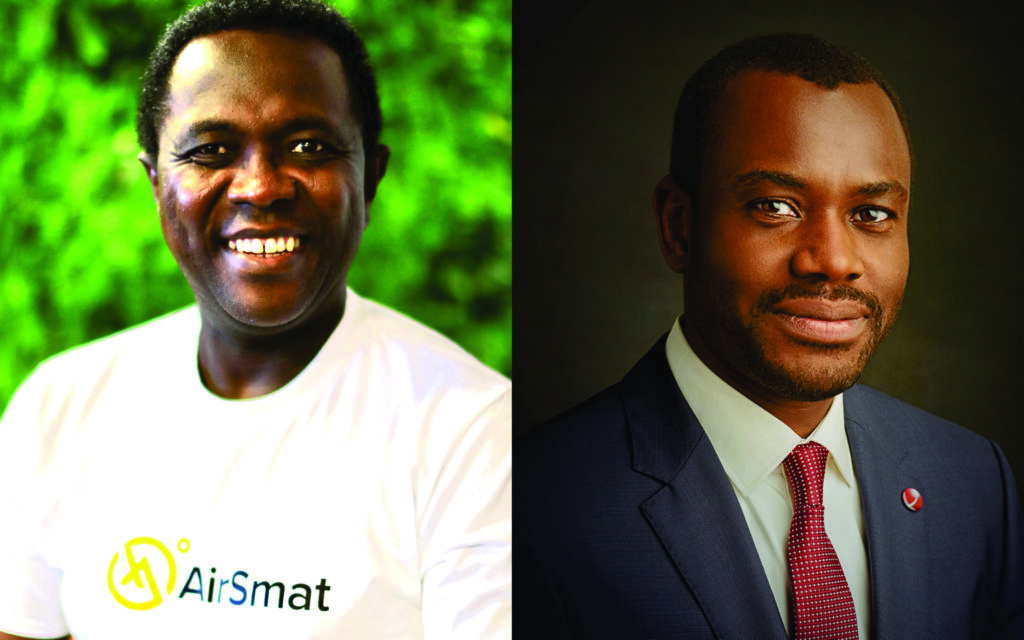

In his words, AirSmat CEO & Co-founder, Soji Sanyaolu stated, “With drone and satellite technology, soil-level, and IoT sensors, we are helping to transform the way farmers and other stakeholders in the value chain collect, manage, and interpret farm data. We are helping farm owners and farmers across Nigeria to eliminate guesswork and drive day-to-day farm operations decisions with precision.” He further explained that “…precise, accurate farm data enables everyone in the value chain, such as banks and insurance companies, make data-driven decisions to support farmers and growers with loans and insurance cover.”

In a recent statement, Dr. Olushola Obikanye, Group Head of Agricultural Finance and Solid Minerals at Sterling Bank stated “if the bank wants farmers to be able to repay loans taken, the bank needs to have a presence in their immediate communities for effective monitoring and coordination of farming activities; this partnership was created to create a strategic partnership that would, among other things, enable Sterling Bank to fulfill its commitment to its shareholders.”

According to Sterling Bank’s CEO, Abubakar Suleiman, “It is difficult to operate in a country and ignore a sector like agriculture that accounts for so much employment and adds so much output to the country’s gross domestic product. At the end of the day, the country’s development starts with agriculture. Apart from the raw materials that come from there, the country must be able to provide food to feed the people and provide the input required for mechanization and manufacturing to take place. To a large extent, I can’t imagine a better place to start to focus if not agriculture.”

The AirSmat team is excited to support Sterling Bank on its mission to make quality food available across Africa and ensure the sustainability and empowerment of growers with the best-in-class technology to increase yield. In this partnership, Sterling has made commitments to its growers, customers, and stakeholders. Furthermore, AirSmat will continue to use its technology to demonstrate that farmers’ success, economic empowerment, and sustainable practices go together to grow food production to attain self-sufficiency in Africa.

About AirSmat

AirSmat addresses the need to increase the efficiency and sustainability of the farming business by offering extraordinary access to real-time information that can help guide pre and in-season decision-making. Using the world’s most advanced solution for diagnostics, we drive precision farming that empowers the agricultural industry to adopt and scale resilient agricultural practices. With drone, satellite, soil-level, and IoT sensors, we are helping to transform how farmers collect, manage, and interpret farm data. We are helping farm owners and farmers across the country to eliminate guesswork and drive day-to-day farm operations decisions with precision. With world resources dwindling and an ever-growing population, especially on the continent of Africa, it is our mission to guarantee food availability for all. For more information, visit https://www.airsmat.com or contact +2347041000987, sales@airsmat.com

About Sterling Bank Plc

Sterling Bank Plc (NSE: STERLNBANK), a leading commercial bank in Nigeria, provides a full range of financial products and services to individuals, businesses, government agencies, and non-profit organizations. Sterling Bank offers a bouquet of solutions to the corporate, retail, and investment banking spaces, from digital banking to investment, trade, and structured finance products, financial advisory services, stock broking, and registrar services. The bank caters to 1.6 million customers through its 2,600 employees, 185 branches and cash centers, 840 ATMs, and 3,000 POS terminals throughout the country. Sterling Bank was established in 1960 and was formerly known as NAL Bank. In 1992, it was partly privatized and listed on the Nigeria Stock Exchange. In 2006, it merged with Trust Bank of Africa, NBM Bank, Magnum Trust Bank, and Indo-Nigeria Merchant Bank and changed its name to Sterling Bank plc. In 2021, Your One Customer Bank’s profit after tax stood at N9.465 billion for nine months, which is N2.096 billion higher when compared to the N7.369 billion gained in the same period of 2020, while the bank recorded N9.384 billion in the third quarter of 2021 as against the N7.280 billion gained in 2020 within the same period. For more details, visit https://sterling.ng.